European property taxes vary significantly across countries, directly impacting overseas buyer investment returns. While Monaco charges no annual European property taxes, Belgium imposes up to 2% annually on property value. Most overseas buyers focus solely on property prices, overlooking substantial purchase costs that range from 5% to 15% of property value depending on location.

Understanding complete European property taxes obligations – both upfront purchase costs and ongoing annual taxes – enables overseas buyers to make informed investment decisions. European property taxes, purchase fees, notary costs, and registration expenses can add €50,000+ to initial investment, while annual European property taxes continue throughout ownership periods.

European property investment involves two distinct financial obligations: substantial upfront costs at purchase, then annual European property taxes throughout ownership. Most overseas buyers focus only on property prices, underestimating additional 5-15% in purchase taxes, legal fees, and registration costs that vary dramatically between countries.

Total European Property Investment Costs Include:

Successful overseas buyers calculate total five-year European property taxes and ownership costs before selecting their investment country. A €400K property in Portugal might cost €425K total upfront, while the same value property in Belgium could exceed €450K immediately, then cost €6,000+ annually in European property taxes.

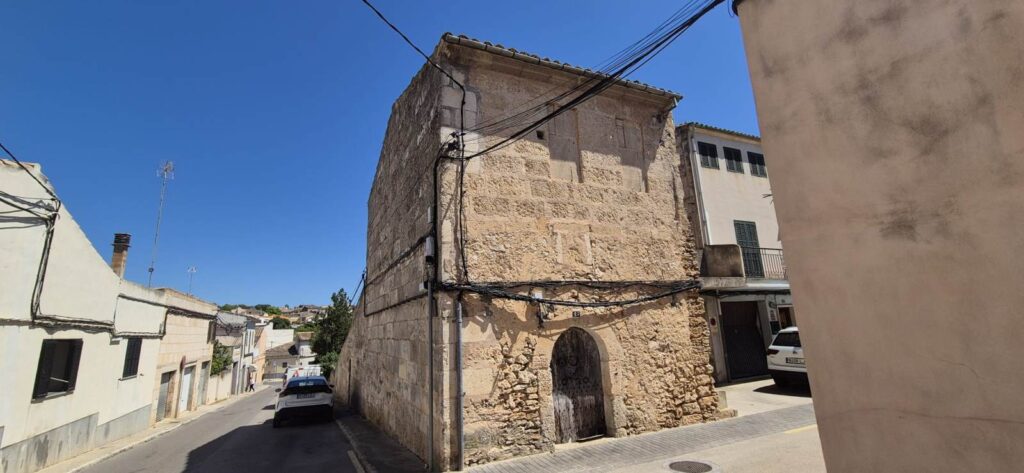

Spain property taxes for overseas buyers include both national and regional components. Total upfront costs typically range 8-12% of property value, while annual property tax obligations remain moderate compared to northern European countries.

Spain Complete Cost Breakdown:

Valencia charges 10% purchase tax on properties over €400K, while Andalusia offers more favorable 7-8% rates. Madrid and Barcelona impose premium rates across all property types, making rural Spanish properties significantly cheaper both upfront and annually.

Spanish cadastral values lag market prices by 30-50%, keeping annual property tax obligations reasonable. However, non-resident income tax on deemed rental income (1.1% of cadastral value taxed at 24%) adds meaningful annual costs for overseas buyers not renting their properties.

Real Example: €350K Barcelona apartment costs €385K total upfront, then €2,800 annually in taxes and fees.

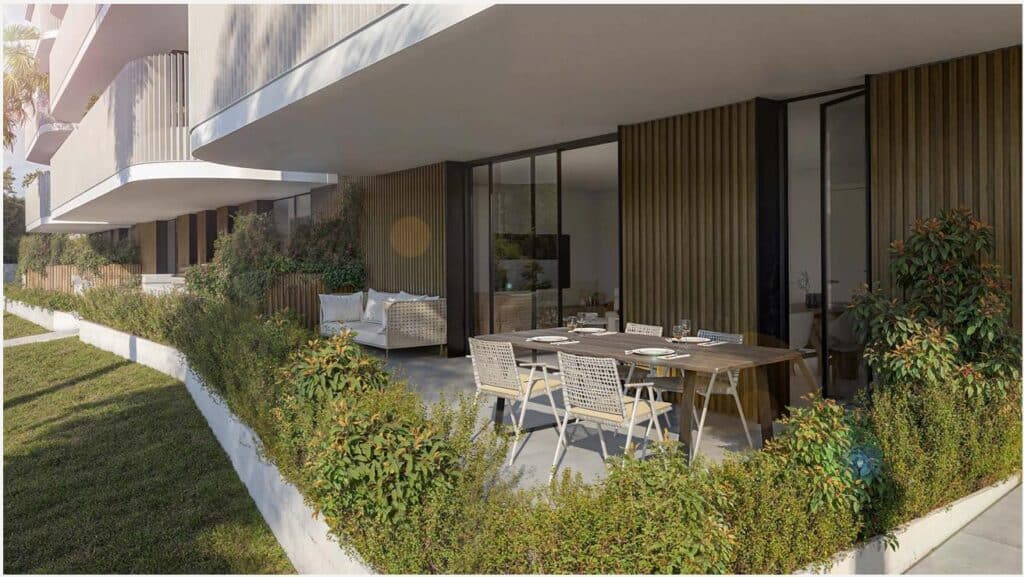

Portugal property taxes for foreign buyers remain among Europe’s lowest for both purchase and annual obligations. Total upfront costs typically add 6-8% to property price, while annual European property taxes rarely exceed 0.5% of property value, making Portugal attractive for international investors.

Portugal Complete Cost Structure:

Portugal’s transparent tax system means no surprise costs or hidden regional variations. Properties under €92,407 qualify for IMT exemptions, while luxury properties over €1M face higher annual European property taxes of 0.7-1.0%. Even premium Lisbon properties maintain reasonable annual obligations.

Portuguese tax assessments reflect 80-90% of market value following recent updates, but the low percentage rates keep total European property taxes manageable. The Golden Visa program previously offered additional tax benefits, though recent changes have modified qualifying investments.

Real Example: €300K Porto property costs €320K total upfront, then €1,200 annually in European property taxes and fees.

Italy property tax overseas buyers encounter varies significantly by property type and region. Purchase costs range 7-12% of property value, while annual obligations depend heavily on primary residence status and luxury property classifications.

Italy Complete Cost Framework:

Italian purchase taxes favor EU residents and primary residences with reduced rates of 2-3%, while non-resident investors face 9% purchase tax plus additional fees. Rome and Milan charge premium rates, while rural Tuscany offers agricultural land discounts.

Cadastral values typically represent 20-40% of market value, making effective annual property taxes 0.15-0.5% of purchase price. However, Italian bureaucracy creates administrative complexity and potential compliance costs for overseas buyers managing their obligations.

Real Example: €400K Tuscan villa costs €445K total upfront for non-resident buyer, then €2,200 annually in taxes and fees.

France property taxes for international buyers rank among Europe’s highest for both purchase and ongoing obligations. Upfront costs commonly reach 10-12% of property value, while annual European property taxes can exceed 2% in premium locations, making France challenging for cost-conscious overseas buyers.

France Complete Cost Structure:

French “rental value” assessments typically equal 8-12% of market value, meaning annual European property taxes often represent 1.0-1.8% of actual purchase price. Paris, Nice, and Cannes impose the highest obligations, while rural properties offer more reasonable European property taxes rates.

International buyers with total French assets exceeding €1.3M face additional wealth tax obligations of 0.5-1.5% annually. Combined with social charges on rental income, France creates substantial ongoing European property taxes for overseas investors.

Real Example: €500K Nice apartment costs €555K total upfront, then €12,000+ annually in European property taxes and fees.

Belgium property taxes for overseas buyers represent Europe’s highest total ownership costs. Purchase taxes reach 12-15% of property value, while annual property tax obligations can exceed 2% of property value, making Belgium suitable primarily for location-focused rather than cost-conscious investors.

Belgium Complete Cost Structure:

Belgian regional variations create complexity, with Wallonia, Flanders, and Brussels each imposing different tax structures. Brussels properties face the highest total obligations, while rural areas offer only slightly better rates.

Cadastral values represent 40-60% of market value, but municipal surcharges multiply basic tax rates by 8-24 times. Combined with massive upfront costs, Belgium creates Europe’s most expensive property ownership experience for overseas buyers.

Real Example: €400K Brussels apartment costs €460K+ total upfront, then €8,500+ annually in taxes and fees.

Monaco property taxes for foreign buyers remain nonexistent for annual obligations, though purchase costs reflect premium market positioning. While ongoing property tax obligations are eliminated, transaction costs and property values create substantial initial investment requirements.

Monaco Property Tax Structure:

Monaco’s zero annual tax obligations attract ultra-high-net-worth overseas buyers seeking European property without ongoing costs. However, average property prices exceeding €40,000 per square meter limit accessibility to exclusive buyer segments.

Foreign buyers typically structure Monaco purchases through corporate entities for optimal tax efficiency. While annual savings are substantial, initial investment requirements dwarf most European property markets.

Real Example: €2M Monaco apartment costs €2.15M total upfront, then €0 annually in property taxes.

European property taxes create substantial differences in total ownership costs across countries. Overseas buyers benefit from calculating comprehensive five-year European property taxes and ownership costs including both purchase taxes and annual obligations when comparing investment opportunities.

5-Year Total Cost Analysis (€400K Property):

These calculations reveal why Portugal dominates overseas buyer preferences, while France and Belgium create substantial long-term costs. Monaco offers ultimate tax efficiency but requires premium purchase prices.

Successful European property investment requires comprehensive analysis of total ownership costs beyond initial property prices. International buyers should evaluate complete property taxes Europe obligations and structure purchases for optimal long-term cost management.

Essential Property Tax Planning Steps:

EurProperties connects overseas buyers with verified tax advisors and accountants across European markets, ensuring proper compliance with complex property tax obligations while identifying optimal investment opportunities.

European property tax obligations vary significantly between countries, requiring careful evaluation for successful international investment. Understanding complete cost structures enables informed decision-making for long-term European property ownership.

No results available