Spain house prices 2025 have reached unprecedented levels, with the property market experiencing extraordinary growth across all 19 autonomous regions. The latest data reveals property values have surged by an extraordinary 11.16% year-on-year in Q1, reaching an average of €2,311 per square meter nationwide.

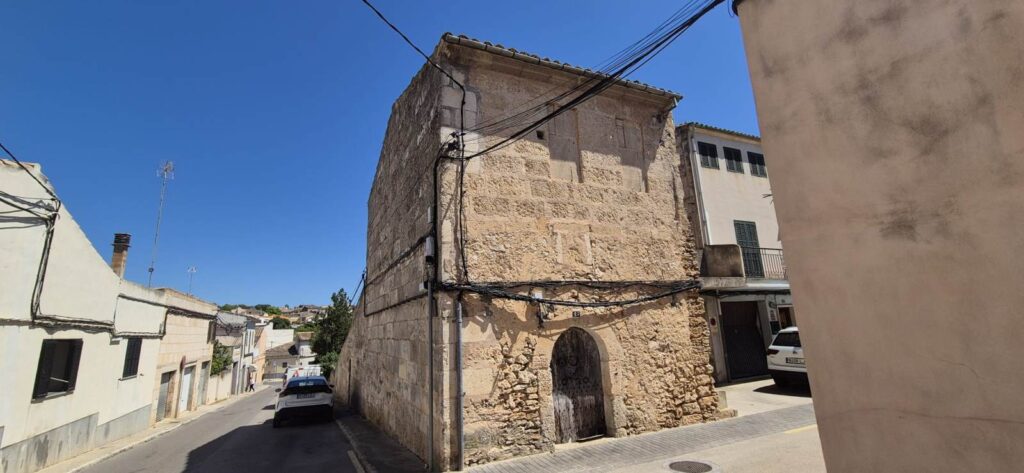

The Region of Murcia has emerged as the standout performer in spain house prices 2025, with property values skyrocketing by an unprecedented 37% year-on-year in May 2025. This dramatic increase positions Murcia as Spain’s fastest-growing housing market, despite maintaining its status as one of the country’s most affordable regions at €1,213 per square meter.

Murcia’s extraordinary growth stems from multiple factors driving demand. The region recorded a 20.6% increase in property transactions in Q1 2025, with new build sales surging an impressive 55.5% to 1,725 units. Foreign buyers now account for 20.4% of all transactions, making it the fourth-highest region for international investment after the Balearic Islands, Valencia, and the Canary Islands.

The Costa Cálida’s appeal lies in its exceptional value proposition. While coastal areas like Costa del Sol command over €3,000 per square meter, Murcia offers Mediterranean lifestyle properties at significantly lower prices, attracting both domestic and international buyers seeking affordability combined with quality of life.

The remarkable growth in Spain house prices 2025 extends across all Spanish territories, with every autonomous region recording positive price increases. This nationwide momentum reflects strong underlying market fundamentals including improved mortgage conditions, sustained foreign investment, and chronic housing supply shortages.

Even traditionally more affordable regions are experiencing significant appreciation, creating opportunities for investors seeking value in emerging markets before prices reach premium coastal levels.

All 19 Spanish autonomous regions recorded price increases in 2024, but growth rates varied significantly when analyzing Spain house prices 2025 data across different markets:

Strongest Growth Regions:

Major Markets Performance:

Most Expensive Regions:

Several key factors are driving Spain house prices 2025 to record levels throughout the year. The European Central Bank’s interest rate cuts from 3% in 2024 have improved mortgage accessibility, with Euribor rates expected to fall to 2-2.5% throughout 2025. This monetary easing has increased buyer purchasing power and market activity.

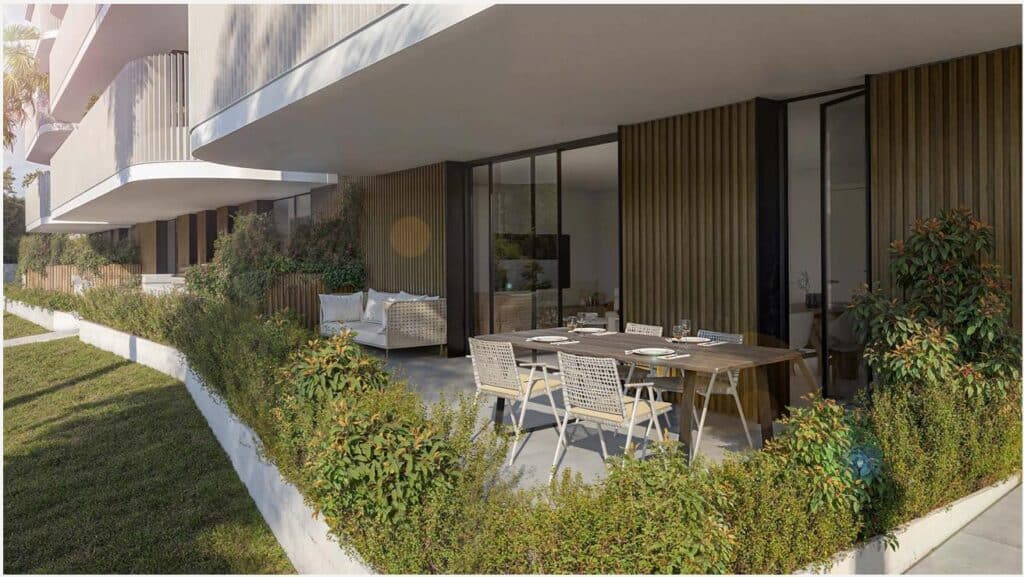

Supply constraints remain critical, with Spain creating an estimated 246,000 new households annually while producing only 85,000-90,000 new homes. This fundamental imbalance continues driving upward price pressure across all regions, particularly affecting new build developments where demand significantly exceeds supply.

Foreign investment maintains strong momentum despite Spain’s Golden Visa program termination in April 2025. International buyers purchased over 87,000 properties in 2023, representing 15% of total transactions. Post-Brexit British demand, combined with American and German investment, sustains international market activity across all Spanish regions.

Population growth adds another demand layer. Spain’s population increased by approximately 1 million between 2022-2023, with immigration contributing significantly to housing demand in major urban centers and coastal regions.

Tourist-oriented municipalities continue experiencing more vigorous price growth than non-tourist areas in 2025. The data shows touristic municipalities averaged 10.3% growth versus 6.5% in non-tourist areas during 2024.

Mediterranean coastal regions benefit from sustained vacation home demand, with waterfront properties commanding 20% premiums in many markets. However, this tourism-driven pricing is creating “oil stain” effects, where demand spreads from expensive coastal centers to more affordable peripheral areas.

Expert forecasts suggest Spain house prices 2025 will maintain strong upward momentum throughout the remainder of the year. Leading industry analysts predict:

Regional variations will persist, with major cities like Madrid, Barcelona, Málaga, and island markets expecting 5-10% increases. Areas with lower initial demand may see growth aligned with inflation rates.

Understanding Spain house prices 2025 market conditions is crucial for international buyers considering investment opportunities. While prices continue rising, regions like Murcia offer exceptional value compared to established coastal markets.

Buyers should consider emerging markets experiencing infrastructure improvements and growing international recognition. The shift toward more affordable peripheral areas around major cities presents opportunities for capital appreciation as the “oil stain” effect spreads.

Fixed-rate mortgages are becoming increasingly popular as buyers seek stability amid potential economic fluctuations. With average Euribor rates declining, financing conditions remain favorable for qualified international buyers.

Spain’s property market fundamentals remain strong, supported by sustained international demand, limited supply, and favorable monetary conditions. The record Spain house prices 2025 growth reflects these underlying strengths while regional variations offer diverse investment opportunities across different price points and lifestyle preferences.

Primary Data Sources:

Regional Market Analysis:

Market Research Reports:

No results available